As an owner of a large number of properties throughout the United States it is important to NNN REIT to be a good steward of the environment.

NNN REIT demonstrates its commitment to good stewardship of the environment in a variety of ways both at our headquarters in Orlando, Florida and at our properties across the country.

Our commitment has recently been recognized by the Institute for Market Transformation and the U.S. Department of Energy Better Buildings Alliance when we were awarded Green Lease Leader Silver for the sustainability-focused updates we added to our form lease.

NNN REIT Headquarters

NNN REIT’s headquarters building is EPA’s ENERGY STAR® certified. Buildings that have earned EPA’s ENERGY STAR® use 35% less energy and generate 35% fewer greenhouse gas emissions. In order to receive this designation, the following components have been met:

NNN REIT’s headquarters building is EPA’s ENERGY STAR® certified. Buildings that have earned EPA’s ENERGY STAR® use 35% less energy and generate 35% fewer greenhouse gas emissions. In order to receive this designation, the following components have been met:

- Utilization of energy efficient LED lighting

- Use of environmentally friendly cleaning products. The products must meet the Green Seal certification standards.

- Variable Frequency drives and more energy efficient motors are purchased and installed in all cooling tower units.

- Mandatory shut down of all lighting and HVAC systems daily.

- The building utilizes a bulb crusher for all lamps which contains a dust removal system that exceed HEPA standards by removing 99.99% of particles for the building fluorescents.

- To minimize generation of waste and release of pollutants, the building requires all paint to be low VOC.

- Storm water retention is managed thru water runoff from roofs and paved areas and are routed to various underground drainage basins. All air handler condensate drain water, fire sprinkler relief and drain water are also piped to this drain field. All water runoff is naturally filtered and returned to the aquifer. This underground system replaces the need for retention ponds.

- Green-friendly native and drought-tolerant plants are used in landscaping to minimize watering needs.

Furthermore, NNN REIT encourages a culture of environmental preservation and efficient usage of environmental resources throughout the company by supporting the following initiatives:

- Associates are provided with a pre-tax payroll deduction for the use of the SunRail train system to limit the number of automobile trips and reduce our carbon footprint.

- Single-stream recycling is implemented at NNN REIT’s headquarters.

- NNN REIT purchases ENERGY STAR® certified desktop and laptop computers, monitors and printers.

- NNN REIT uses ENERGY STAR® power management settings on our computers and monitors.

- NNN REIT recycles old computer equipment, printers and any other electronic items.

- NNN REIT disposes all ink cartridges utilizing TOSHIBA’s recycling program.

- NNN REIT’s document destruction provider recycles all shredded materials (resulting in annual savings of roughly 200 trees a year).

- NNN REIT requires all associates to use personal cups and has installed water machines to limit the use of plastic cups and bottles.

- NNN REIT’s has located its headquarters where our associates can reduce their carbon footprint by using the following green transportation programs:

- Short walk to SunRail commuter rail line station

- Electric vehicle charging stations and designated parking spaces for hybrid vehicles

- Bicycle storage lockers as well as bike rack

- Electric commuter bike rental stations

- Free Lynx bus for travel throughout downtown

- Ample lunch options easily within walking distance of our office

NNN REIT Portfolio of Properties

The properties in NNN REIT’s portfolio are generally leased to our tenants under long-term triple net leases which gives our tenants exclusive control over and the ability to institute energy conservation and environmental management programs at our properties. NNN REIT’s tenants are overwhelmingly large companies with sophisticated conservation and sustainability programs. These programs limit the use of resources and limit the impact of the use of our properties on the environment, including, but not limited to, implementing green building and lighting standards, and recycling programs.

Generally our leases also require the tenants to fully comply with all environmental laws, rules and regulations, including any remediation requirements. Our risk management department actively monitors any environmental conditions on our properties to make sure that the tenants are meeting their obligations to remediate or remedy any open environmental matters. On all properties that NNN REIT acquires we obtain an environmental assessment from a licensed environmental consultant to understand any environmental risks and liabilities associated with a property and to ensure that the tenant will address any environmental issues on our properties.

When a new lease is entered with a tenant we actively engage with our tenants to promote good environmental practices on our properties, including discussions regarding the following:

- Environmental sustainability and recycling requirements

- Energy efficiency requirements, including Energy Star requirements, and EPA Water Sense program requirements

- Environmental conservation and green building requirements, in accordance with industry best practices

- Energy usage reporting requirements, including energy and water data reporting for all new and renewing tenants

Top Tenants Reporting Sustainability Data

| ESG-Reporting Tenants | % of Total (1) |

|---|---|

| 7-Eleven | 4.5% |

| Mister Car Wash | 4.0% |

| Dave & Buster's | 3.8% |

| BJ's Wholesale Club | 2.4% |

| Walgreens | 1.8% |

| Sunoco | 1.7% |

| Casey's General Stores (convenience stores) | 1.6% |

| Lifetime Fitness | 1.3% |

(1) Based on the annual base rent of $874,301,000, which is the annualized base rent for all leases in place as of March 31, 2025.

Climate Preparedness

NNN REIT regularly monitors the status of impending natural disasters and the impact of such disasters on our properties. In most leases NNN REIT’s tenants are required to carry full replacement cost coverage on all improvements located on our properties. For those properties located in a nationally designated flood zone, NNN REIT typically requires its tenants to carry flood insurance pursuant to the federal flood insurance program. For those properties located in an area of high earthquake risk, NNN REIT typically requires its tenants to carry earthquake insurance above what is typically covered in an extended coverage policy. In addition, NNN REIT also carries a contingent extended coverage policy on all of its properties which also provides coverage for certain casualty events, including fire and windstorm.

Carbon Offsets

As part of our efforts to be a good steward of our planet, NNN REIT has purchased carbon offsets from Native, a Public Benefit Corporation, to offset our estimated Scope 1 and 2 emissions related to our Orlando headquarters, as well as our estimated annual Scope 2 emissions from the vacant properties in our portfolio as of year-end 2022. We selected Native because of their experience and expertise in carbon offset projects. Native has a 21-year track record of structuring climate action projects, with over 80 projects built, validated and verified in the last ten years.

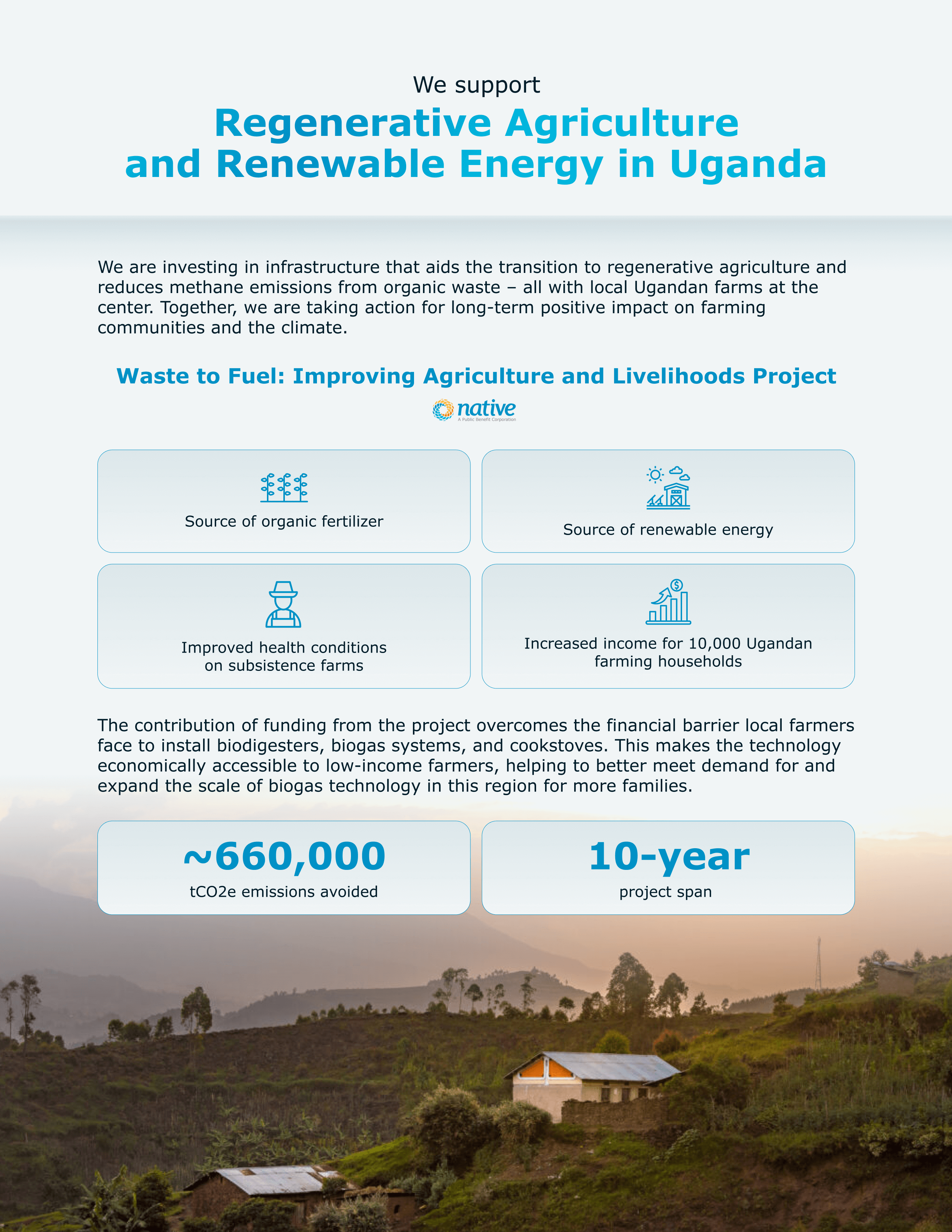

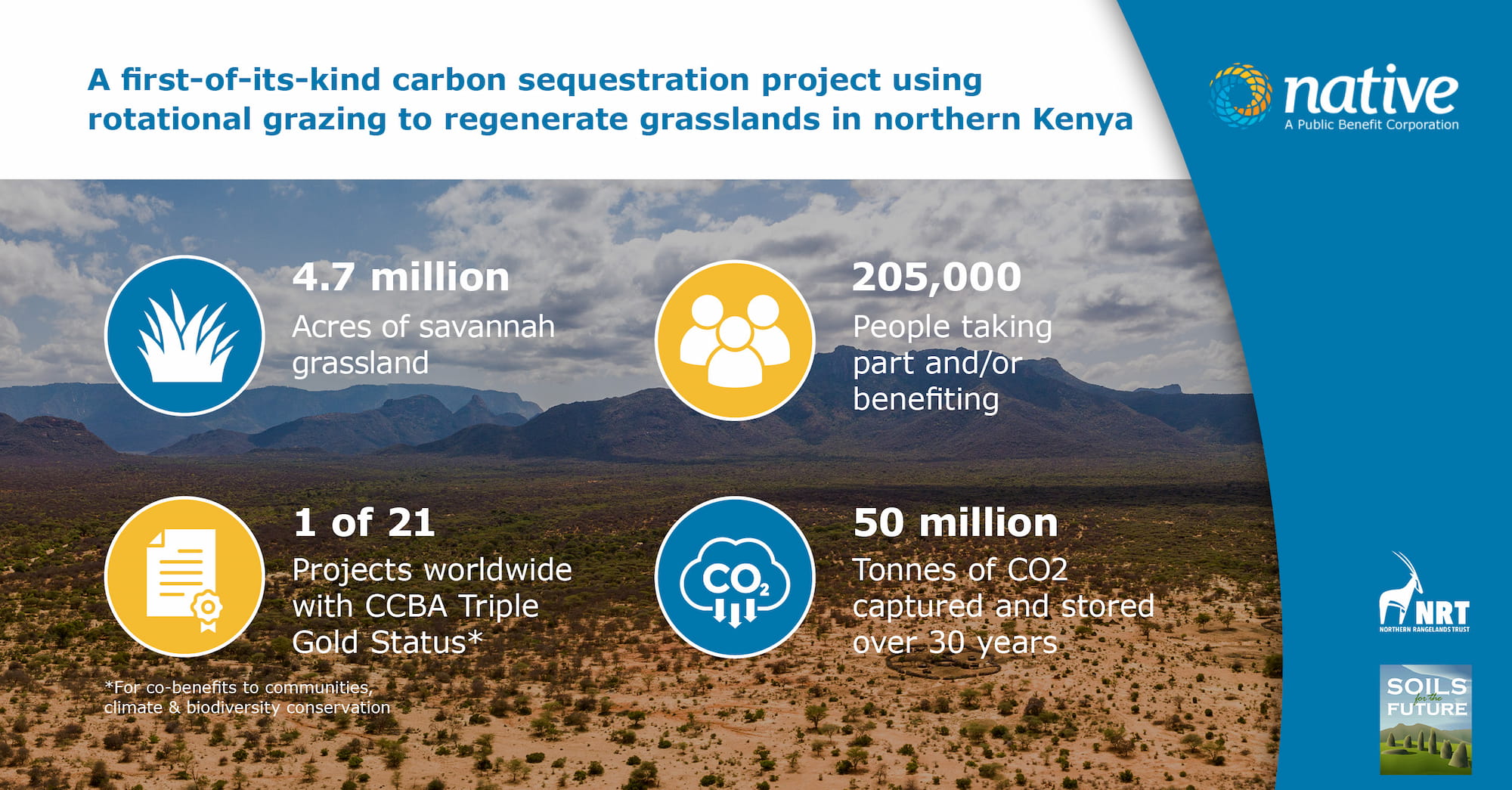

The offset projects we invested into are the Waste to Fuel project in Uganda and the Northern Kenya Rangelands Project.

Regenerative Agriculture and Renewable Energy in Uganda

The Waste to Fuel project is providing small family farms with a small-scale digester that generates biofuel for cooking and organic fertilizer. Over the course of the 10-year project, more than 10,000 farming households in the several coffee and sugar growing regions of Uganda will participate and contribute to the reduction of carbon emissions.

The project reduces emissions in two key ways. First, the systems reduce methane emissions from organic waste by capturing and burning the gas, preventing emissions that would otherwise come from the decomposition process. Second, the farmers participating in this project currently rely heavily on fuelwood to meet their energy needs. These systems displace those former energy sources with biogas. Most often used to fuel cook stoves, the biogas can also be used for other thermal processes in the home and on the farm.

The installation of these systems on subsistence farms can lead to multi-faceted benefits:

- The use of biogas powered cook stoves and water heaters protect forests and biodiversity and improves indoor air quality by displacing the need for firewood in homes.

- Families have an increase in income from the money they save on energy by displacing the use of firewood with biogas.

- Women and girls can participate in more productive activities by expending less time and energy collecting firewood.

- Farmers and their families benefit from a reduction in agrochemical pollution and save money on inputs with organic, farm-generated fertilizer that displaces the use of chemical fertilizers and improves food production.

- The project helps advance United Nations Sustainable Development Goals (UN SDGs) 7 and 8, which strive to ensure access to affordable, reliable, sustainable and modern energy and promote inclusive and sustainable economic growth.

Northern Kenya Rangelands Project

The Northern Kenya Rangelands Project has been developed to improve grassland health and sequester carbon in the soils of community rangelands in northern Kenya by making livestock grazing more sustainable. It is the first large, landscape-scale soil carbon project of its kind in the world. The land, covering more than 2 million hectares, is on the path to improved soil health, more robust ecosystems and increased carbon sequestration thanks to these strategies. It utilizes carbon sequestration to regenerate grasslands in Northern Kenya to improve grazing practices in the region. Carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. It is one method of reducing the amount of carbon dioxide in the atmosphere with the goal of reducing global climate change. The Northern Kenya Rangelands Project is 1 of only 21 projects worldwide with a CCBA triple gold status.

“The Northern Kenya Rangelands project is the world’s first large-scale grasslands soil carbon project, and currently one of the few landscape-level carbon removal ventures on the market today. Supporting this project helps to improve grassland health and sequester carbon in the soils, generate income for local communities, improve resilience to drought and climate change, and enhance habitats for key endangered species.”

*NNN REIT worked with Native, a Public Benefit Corporation to estimate our annual Scope 3 emissions from the vacant properties in our portfolio. Native used the US EIA’S Commercial Buildings Energy Consumption Survey (CBECS) data to estimate the annual energy consumption of our vacant facilities. Native utilizes up-to-date, publicly available emissions factors to calculate GHG emissions, and together we have done our best to ensure our emissions estimates are as accurate as possible. Despite this, we do not guarantee that our emissions estimates are 100% accurate or complete, as the calculation of emissions requires the use of averages and assumptions, and is only as accurate as the data available.